Hey everyone,

Here are 5 resources I studied this week.

On each content, I have created notes with the key concepts.

📖Feel free to save it in your Second Brain.

1. Poor Charlie’s Almanack

This is the book that I’m reading, "Poor Charlie's Almanack" is a collection of speeches and essays by Charles T. Munger, which offer insights into his philosophy on life, business, and investing.

3 Key concepts :

Berkshire's Acquisition Strategy

Two-thirds of acquisitions don't work. Ours work because we don't try to do acquisitions - we wait for no-brainers.

Charlie Munger

The art of say "No"

Charlie realizes that it is difficult to find something that is really good. So, if you say 'No' ninety percent of the time, you're not mising much in the world.

Otis Booth

Benjamin Franklin success is due to:

His appetite for hard work

His insatiable curiosity and patient demeanor.

Preparation

Patience

Discipline

Objectivity

2. How to analyze a 10-K ?

Here is my Mind map of @QCompounding thread. That’s allow me to sum-up content visually.

Feel Free to save it.

3. Here are 6 investment frameworks you should know

Another great thread of @QCompounding. He lists 6 investment tenets from the greatest investors.

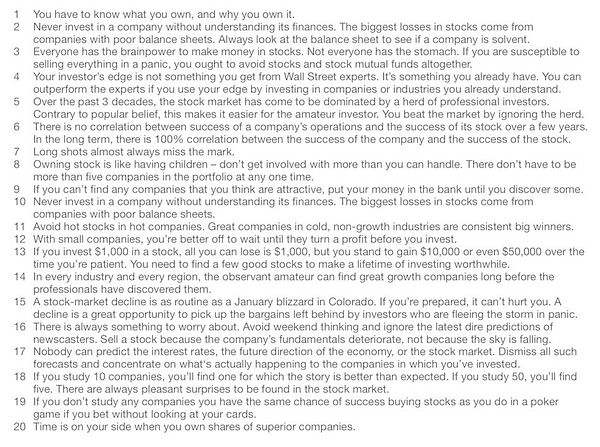

Peter Lynch

Charlie Munger

Warren Buffet

Mohnish Pabrai

Philip Fisher

François Rochon

4. Everything is a DCF model by Michael J. Mauboussin

In this article, we learn the advantages and disadvantages of the different valuation methods. (DCF, Relative valuation)

And also for which type of investor this approach can work

Lessons learned :

1. The price is terribly attracted by the intrinsic value of the company.

2. The objective is therefore to buy a company below its intrinsic value.

3. In the private and public markets, the value is always to determine the future cash flows. So everything is about DCF model

All my learnings here

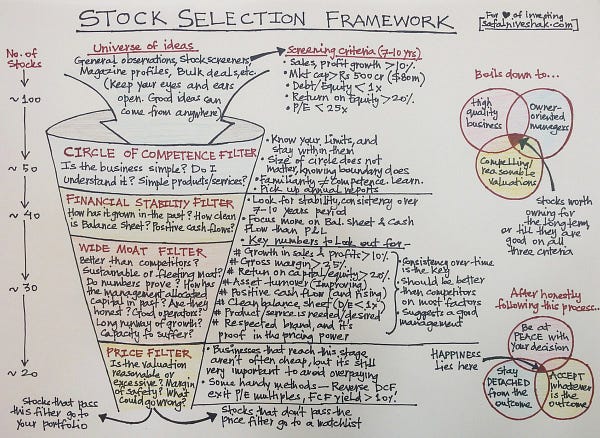

5. Let's Understand Stock Market through Visual Handcrafted Notes

Visual help me to understand,

Here are 18 visuals to understand stock market.

Thanks for reading.

This newsletter is a completely reader-supported publication. The best way to support it is to Subscribe and follow me on Twitter.

The arts of invests,